Business

NTPC ne Mahapreit ke sath 10 GW renewable energy JV sign kiya

NTPC Green Energy ne Mahapreit ke sath 10 GW renewable energy parks banane ke liye JV sign kiya, shares mein aaj 0.36% ki badhotri dekhi gayi.

Business

India US Trade Talks: Efforts to fast-track deal begin

India US Trade talks positive rahe New Delhi me, dono sides ne decide kiya hai ke trade deal ko early conclude karne ke liye efforts fast kiye jayenge.

India

Indian rupee hits record low against US dollar

Indian rupee ne US dollar ke against ek naya record low touch kiya ₹88.47 par. Import cost, petrol prices aur inflation par iska direct impact hoga.

Business

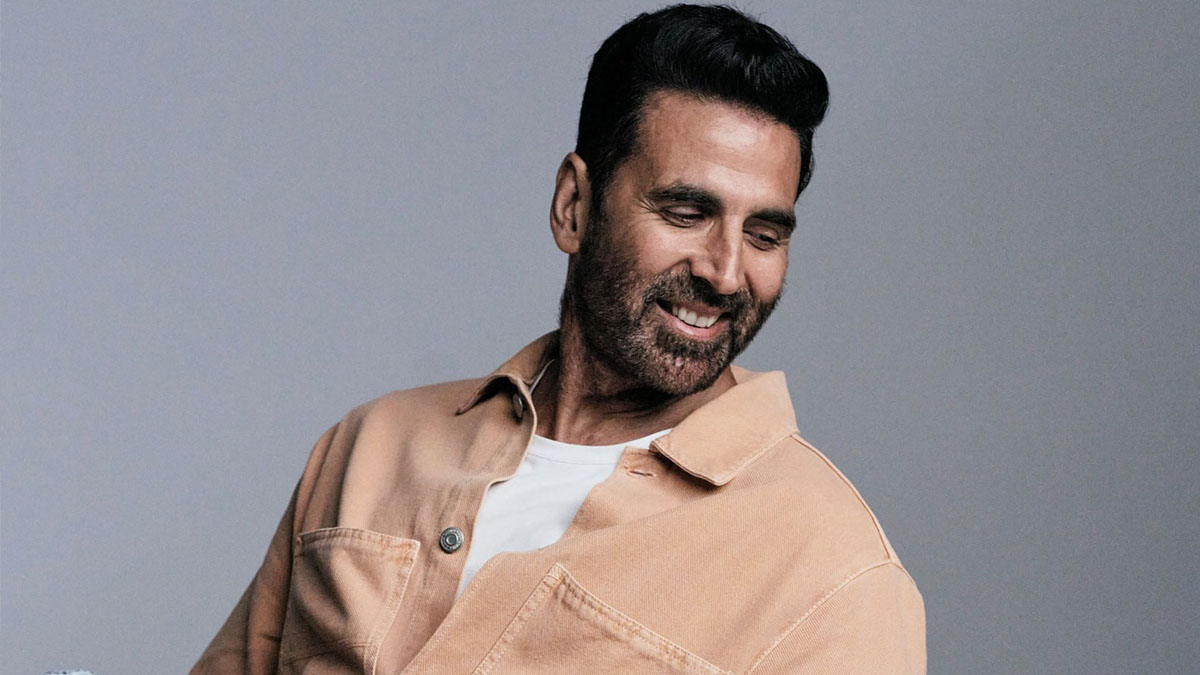

Akshay Kumar Property Deal: 2 Flats Beche Rs 7.10 Cr Mein

Akshay Kumar property sale ne fir banayi headlines—Borivali ke 2 flats Rs 7.10 crore mein beche, 8 saal mein 90% se zyada return mila.

Business

SEBI ne Swiggy, Hyundai Motor India ko IPO approval diya

SEBI ne Swiggy, Hyundai Motor India, Acme Solar aur Vishal Mega Mart ko IPO launch karne ki permission di hai. IPO plans ko ab greenlight mil gayi hai.

Business

Reliance Infra ke shares 20% badhe, Rs 475 cr loan kam kiya

Reliance Infra ke shares 20% badhe aur upper circuit Rs 282.75 per touch huva, Company ne apne karz ko Rs 3,831 crore se ghata kar Rs 475 crore kiya.

-

India5 years ago

India5 years agoRajasthan Mein Bijlee Girne Se Selfie Lene Walon Ki Maut, Uttar Pradesh Mein Bhi 41 Ki Maut.

-

India5 years ago

India5 years agoRahul Gandhi: Jab Vaccine Free Hai To Private Hospital Mein Paise Kyun Liye Ja Rahe?

-

India3 years ago

India3 years agoEx CM HD Kumaraswamy Aur JDS President CM Ibrahim Ne Md Feroz Khan Ko Bidar Dist Ka JDS Youth President Banaya

-

India5 years ago

India5 years agoTwitter Ne Jammu-Kashmir Aur Ladakh Ko Bataya Alag Desh.

-

Entertainment5 years ago

Entertainment5 years agoMarvel Studios’ Shang-Chi and The Legend of The Ten Rings, Naya Trailer

-

Entertainment4 years ago

Entertainment4 years agoFilm ke set par ghaayal hui Priyanka Chopra, khoon se lathpath viral huwi tasveer

-

World5 years ago

Bosnian Muslim Miners Ne Satah Se 1,640 Feet Neeche Roza Khola

-

India5 years ago

India5 years ago2018 mein post se hataye jane ke baad Former CBI chief pegasus nigrani mein jode gaye: Report